COLA Increases — But Not the Stuff You Drink!

August 15, 2022 | TS Prosperity Group

When I hear someone talking about COLA, I think of that deliciously syrupy carbonated beverage that is generally enjoyed right out of a bottle! And if I hear there’s an 10.8% increase on the horizon, I start dreaming of COLA trucks bringing 10.8% more bottles of that delightful drink to my local grocery store. Mmm…more COLA for me!

However, I’m completely mistaken on that front! In current events, the COLA increase that I’ve been hearing about actually refers to the Cost-of-Living Adjustment that retirees may be seeing in the next year. If you take to the Social Media Stratosphere and you’re likely to hear twitters of potential Social Security COLA increases somewhere between 7.3% and 10.8%--a substantial hike, even from last year’s 5.9% for current retirees. But is it really enough?

COLA (Cost-of-Living Adjustment) was introduced in 1975 to counteract inflation for Social Security benefits and Supplemental Security Income (SSI) and ensure a retiree’s purchasing power remains the same. COLA is determined by the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)1—in other words, the U.S. Bureau of Labor Statistics analyzes and averages the change in prices on consumer goods and services (i.e. food, gas, medical expenses, cars, transportation, and even tobacco and alcohol) over a specific period of time and that change is represented by a percentage2. TA-DA: Inflation!

Here’s where the calculation of COLA starts to get a bit tricky…

First, when averaging the percentage increases of goods and services for the Consumer Price Index, there is equal weight for a consumer category of “clothing/apparel” as there is on “food” as there is on “new cars” as there is on “medical care”. What this means is that, even though consumers may not spend as much money on some of these categories that make up the CPI-W, the U.S. Bureau of Labor Statistics averages them on the same weight level.

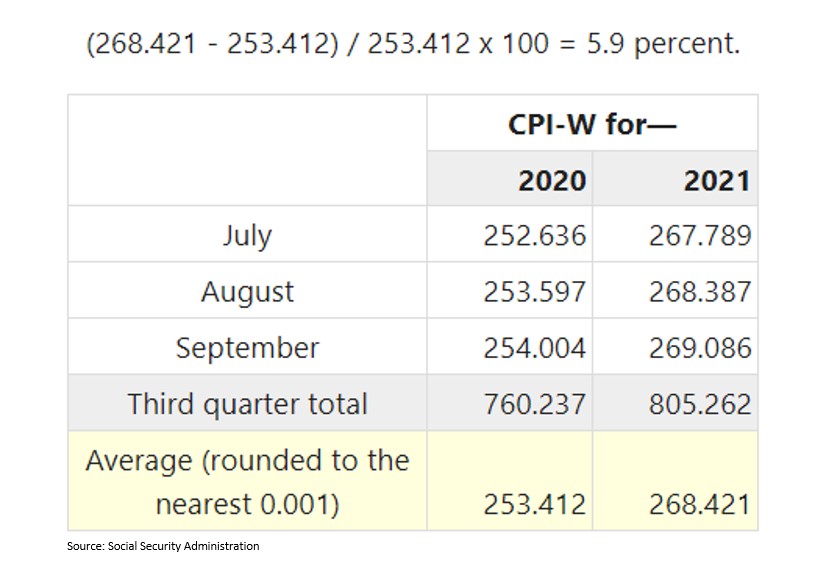

Second, the COLA Computation is the average of averages! They average the CPI-W figures for one quarter, compare that figure to the average CPI-W figures to the prior year’s quarterly average and then compute the inflation rate of those numbers3. (See table for the computation of 2022’s 5.9% COLA).

Circling back to the question of a COLA increase up to 10.8% for 2023 to help retirees maintain the same purchase power, let’s illustrate the table below:

We have seen in just the last 12 months major increases in Fuel Oil and Gasoline—106.7% and 48.7%, respectively! We certainly have felt that at the fuel pumps lately! And even that 10.1% increase in Food was hard to swallow (no pun intended!)

Going back even further, the last 10-years has seen the heaviest increases in Fuel Oil, Shelter, and Medical Care. The last 10-years of COLA increases has only accounted for a 22.7% increase—not nearly enough to cover the erosion of purchase power of these major consumer categories.

So how can we combat this disparity between inflation on the things we more frequently spend our money on and retirement benefits like Social Security or SSI? Answer: Have a sound Investment Strategy to subsidize those benefits!

With TS Prosperity Group, we look at your entire financial picture, listen to you, and formulate a plan that will manage your risk while optimizing your return to ensure you have enough money to truly maintain your future purchasing power at retirement. To start your Investment Strategy call (844) 487.3115 and schedule an appointment today!

1 Cost-of-Living Adjustment (COLA) Information

2 Consumer Price Index

3 COLA Computation

At TS Prosperity Group, we IGNITE PROSPERITY® by helping our clients do more with their money. Whether it’s saving a little extra cash each month or accomplishing a long-term strategy, our goal is to help you transform your financial life. Call and schedule an appointment today, one of our team members would love to help you do more with your money at TS Prosperity Group. TS Prosperity Group is based in Council Bluffs, Iowa, with clients across the Midwest. For more information visit tsprosperitygroup.com or call 844-487-3115. #igniteprosperity

Investment products offered by TS Prosperity Group are: Not a Deposit • Not FDIC Insured • Not Insured by any Federal Government Agency • Not Guaranteed by the Bank • May Go Down in Value.