Wealth & Investment Planning Services: Monitoring Your Risk and Return

At TS Prosperity Group, we have a team specifically designed to help families with key fiduciary services and investment planning. As a division of TS Bank, TS Prosperity Group is firmly rooted in foundational financial principles and a unique institutional investing approach. We strive to create core portfolios supported by our investment philosophy of appropriately balanced investment risk management.

Investment planning can be intimidating, but it doesn’t have to be. Our advisors look forward to partnering with clients and helping them make wise investment decisions to support their families and their future.

Schedule your Discovery Meeting

What is a Good Investment?

There is no such thing as a one-size-fits-all approach to investing and investment planning. However, our financial experts have developed an investment strategy contrary to most industry recommendations: we serve our clients by focusing on investment risk management first and return second.

Our team didn’t merely adapt conventional industry portfolios in order to fit this strategy; we built new portfolios from the ground up. Inspired by a desire to both build wealth and protect it. Our strategy is designed to provide consistent returns while taking less risk than industry standard portfolios.

What is risk in investment planning?

When it comes to finances and investments, risk refers to the amount of uncertainty or potential financial loss associated with an investment decision. Different types of investments have different degrees of inherent risk and return potential.

What is risk tolerance in investing?

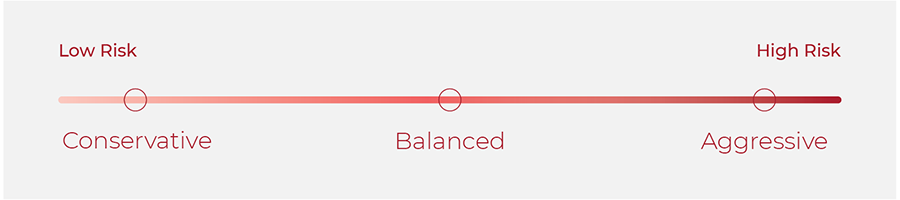

Risk tolerance refers to each individual’s preferences for investment risk management. Some investors prefer to minimize the risk of losing money, while others choose to make bolder, riskier investment choices in hope of making more money.

Risk tolerance is a spectrum. Investors at one end of the spectrum are risk-averse, preferring to make investment decisions with minimal risk because they want to protect their assets. On the other end of the spectrum are investors with very high-risk tolerance. These individuals may choose to make riskier investments due to the higher probability of a larger return on investment.

There is no right or wrong way to approach risk tolerance in investing. The balance of investment risk and return is a personal choice based on your financial position and goals. Partnering with the TS Prosperity Group team can help you understand and explore your personal risk tolerance. Guided exploration makes it easier to make investment decisions that align with your risk tolerance and preferences.

If you have a low-risk tolerance, we can help you understand which investment type typically carries the least risk. If you’re comfortable with more risk, our team will guide you toward the best investment options for you.

TS Prosperity Group clients understand investing is a collaborative process with agreed upon up-front risk and return targets. Investment management decisions are managed by our team of trusted investment professionals. As a regulated fiduciary advisor, we are held to a high standard of care and embrace this duty by placing the interests of our clients first.

Investment Planning Services

Our investment team is continually tracking market conditions and looking for potential opportunities and threats in the path ahead. We discuss market trends, adapt to changes in trends and re-allocate our portfolios quarterly based on long-term foundational strategy — not momentary news stories.

Our clients can have confidence in knowing their portfolios are not the result of past legacy decisions but are a deliberate result of fresh insights and the calculated investment planning customized for their individual needs and goals.

TS Prosperity Group can help you and your family with investment planning services in the following areas:

Investment planning

We will determine your risk tolerance and begin making decisions based on your preferences for investment risk and return priorities.

IRA (Traditional, ROTH, SEP, SIMPLE)

We can discuss your various retirement savings options to make sure you will have enough money to support your desired lifestyle in retirement.

Rollovers from a 401(k) plan

Our investment and retirement experts can offer advice about 401(k) rollover options and pros and cons based on your unique situation.

1042 exchange

Qualified TS Prosperity Group financial professionals can walk you through the 1042 exchange process and make sure you understand what options make sense for you and this type of transaction.

|

Trisha McCoid - VP of Wealth Planning

Trisha joined the TS Prosperity Group in June of 2022. A Council Bluffs Native, Trisha brings with her a passion and zeal for the Community and the people who work and live here. With nearly two decades of experience in developing relationships with a financial background, her skillset is a dynamic combination for her role. Her desire to help people meet their goals is the driving force; and palpable when meeting with her. When not busy working in the community, volunteering for local non-profits, or serving as a board member for various organizations, you may find her shopping or dining at her favorite neighborhood small businesses, catch her at the park or the ball field with her kids, or watch her drive by in her beloved Pink Jeep!

712-487-1200

Schedule an Appointment with Trisha

|

Our Investment Planning Process

Our process begins and ends with you, the client. Serving clients successfully for more than 90 years has taught us we must always keep your goals top of mind. We are proud of our ability to leverage all of TS Prosperity Group’s unique collective insight and philosophies to build an investment risk and return strategy based on our clients’ unique position and objectives. Here’s our simple process for establishing an investment planning relationship:

- Call to schedule an appointment

- Attend a 60-minute discovery meeting

- Attend a 60-minute solution meeting

- Complete account opening paperwork

- Account funding

Not quite ready for an appointment? Try out our simple online calculator to see where you're at on your path to meeting your retirement and/or savings goals. Click the link below to get started.

Online Calculator

We will meet regularly to assess your portfolio's performance against market benchmarks to provide an objective evaluation of how well we performed and to learn how we can better serve you.

Partner with TS Prosperity Group for Exceptional Investment Planning Services

No matter where you are on your financial journey, our investment planning strategies are tailored to your unique situation, goals and stage of life. We take a personalized, long‑term approach, designed to support you today while remaining flexible as your circumstances change. With a comprehensive suite of tax planning services, we’re able to meet you where you are and adapt as your needs evolve, always with integrity, clarity and your long‑term prosperity in mind.

If you’re ready to take a more proactive approach to managing taxes and maximizing long‑term savings, contact TS Prosperity Group by calling 844‑487‑3115 or by clicking the link below to request a Discovery Meeting. This approximately 60‑minute conversation is designed to determine whether a tax planning relationship is the right fit for both you and our team. We’ll take time to learn about you, your story and your goals, and you’ll have the opportunity to ask questions and better understand our process.

Schedule your Discovery Meeting

Request Your Free Digital Download for Ten Common Problems Most Investors Face

TS Prosperity Group offers investment planning and is based in both Council Bluffs and Treynor, Iowa, with clients across the Midwest. The investment planning team can meet with clients in person across southwest Iowa including Council Bluffs, Treynor, Atlantic, Corning or Ames, Iowa or virtually from anywhere.