2021 tax season with Collins Consulting

December 10, 2021 | Collins Consulting

As we approach the 2021 tax season, Collins Consulting will not be doing in person tax return appointments. This is not due to COVID-19, but because Congress has significantly added to, and changed, the required information on a tax return which has made it much more complex and time consuming.

All tax preparation will be done via drop offs, email or fax:

- There is a secure drop off box in the main entrance of our location inside of TS Bank in Treynor, Iowa. The drop box is located in the front vestibule near the ATM and available for drop offs 24/7

- You can also submit documents to customerservice@collinsconsultingservice.com

- Fax documents to (712) 314-6334

A Collins Consulting tax preparer will contact you via phone, email or Zoom (video conference) to review your return before its finalized. Once the return is finalized with you, we will send the tax documents via DocuSign for you to e-sign and return. If you do not have access to a computer or prefer a paper copy of your return, you may request a paper copy for an additional fee and we can discuss your delivery choice at the time of your return review. From the DocuSign email, you can download to save or print a copy of your tax return.

Additionally, we are asking clients to drop off copies of documents and not the originals. This will allow us to work on your return digitally, via email through secure e-signatures.

Please complete the REQUIRED organizer and return to Collins with your tax documents if you are filing personal taxes.

Please complete the REQUIRED organizer and return to Collins with your tax documents if you are filing LLC/corporate taxes.

This will ensure our tax preparers have the most accurate information, and will know what to discuss with you while reviewing your return. You may request a personalized organizer by emailing customerservice@collinsconsultingservice.com.

This year has brought a lot of changes to this area and we would like to bring your attention to a few different tax strategies and information that might impact you.

Economic Impact Payment (EIP3) (stimulus)

The EIP payment made in 2021 is not taxable income, but will be reconciled on your 2021 tax return, so if underpaid, you could receive additional funds. If you were overpaid, there will not be an increase in taxes on your 2021 tax return. The exact amount of the EIP will need to be known to record on your 2021 tax return. For additional information refer to the IRS website here. You should have received form 1444C from the Internal Revenue Service around the time you received your payment. Please forward that form if you have it available.

What changes were made that may affect my 2021 tax return?

- Child care credit limit increased to $4000 for one child or $8000 for two or more children. The amount of the credit begins to phase out if income is above $125,000.

For more information, refer to the IRS website here.

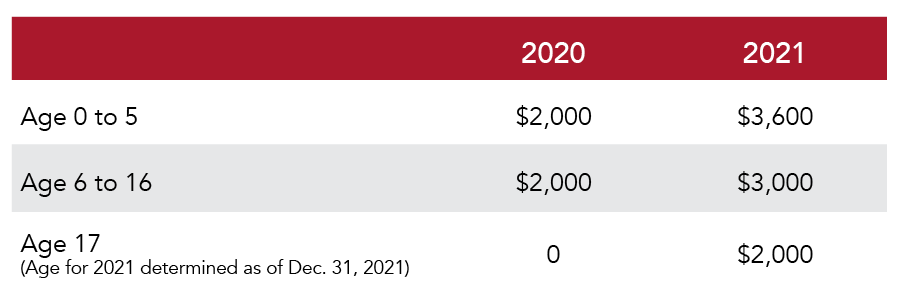

- Advanced Child Tax credit is required to be reconciled on 2021 tax return. Please provide Form 6419 that you should receive in January 2022 from the IRS. Excess advanced child tax payments you’ve received may not have a payback requirement or may be required to be partially or fully paid back on your based on your 2021 income or loss of a dependent claimed in the prior year. We will help with the calculation when preparing your tax return. For more information, refer to our blog here and the IRS website here.

- Unemployment is taxable in 2021 – unlike 2020

- Contributions of up to $600 on a joint tax return and $300 on a single tax return are deductible without itemizing. Donations of goods (rather than cash or check) is not allowed for this deduction.

- The standard mileage rate was reduced to $.56 per mile that is down from $.575. See here for mileage rates for medical and charitable purposes.

- The teacher credit (also for principals and counselors) including expenses for COVID-19 supplies is $250 for federal but $500 for Iowa.

- Business meals purchased at restaurants are 100% deductible in 2021 and 2022, which was was increased from 50%. This would be for self-employed individuals as it is no longer allowed as an itemized deduction.

- Residential energy for insulation, doors and windows was reinstated but with $500 lifetime maximum that began years ago, so credit limit may have been used in prior years. The Wind and Solar energy credit continues.

- Online sales of just $600 or more are required to be reported to the IRS on Form 1099K by online sales organizations (limit was $20,000).

- Iowa returns only – K-12 tuition, books and extracurricular activity expense increased to $2000 per child, up from $1000, previously.

- Volunteer firefighter and EMT deduction increased to $250 from $100

What tax changes were discussed by Congress and have been in the news but have not been passed?

No change in individual, corporation, capital gains tax rates. Also no change in estate (death) taxes and no change in bank reporting on your business or personal bank accounts.

IRS online account

The IRS has a new IRS online account that is significantly improved from the past. It is a two-factor authentication process that protects personal information. It provides an option to obtain information that the IRS has sent you or the IRS has on file, that is an alternative to making contract with the IRS via phone or mail. Once you have setup and have access, you can verify how much stimulus (EIP3) you received in case you do not have Form 1444C and other information. For more information, refer to the IRS website here.

We are looking forward to another busy tax season. If you have any questions, contact us online or give us a call at (712) 487-3853.

About Collins Consulting: Collins Consulting is a full-service tax and accounting firm, started in 1970 by Norm Collins in Treynor, Iowa. In August of 2018, TS Banking Group acquired Collins Consulting as a wholly-owned subsidiary.