Things to know for maximizing your social security

January 24, 2020 | TS Prosperity Group

The metaphor of a three-legged stool has often been used to illustrate the three most common sources of retirement income: Social Security, retirement plans, and personal savings. All three “legs” are vital in order for you to have a stable & adequate income in retirement. For purposes of this discussion, we will focus on just one of the legs, Social Security.

What do you pay, and what are your benefits?

The Social Security tax rate is 6.2%, which is the rate that is applied to the wages that you earn. This rate is matched by your employer, so there is a total of 12.4% of your earned wages paid into Social Security. That means that you pay 12.4% if you are self-employed. The maximum earned wages that are subject to Social Security taxes in 2020 is $132,900. The average monthly benefit received at normal full retirement age was $1,461 as of January 2019, and the maximum monthly Social Security benefit payment of a 2019 retiree at full retirement age was $2,861.

Often times Social Security benefits are only associated with retirement income; however, other types of Social Security benefits include disability, supplemental Social Security Income (SSI), spousal benefits, and survivor benefits. As for spousal benefits, you are entitled to up to 50% of your spouse’s Social Security benefits or all of your own, whichever is higher. When it comes to survivor benefits, you are entitled to up to 100% of a deceased spouse’s benefits or your own, whichever is higher. This is reduced if your spouse claimed early and could be increased if your spouse claimed after their full retirement age.

What determines your monthly benefit?

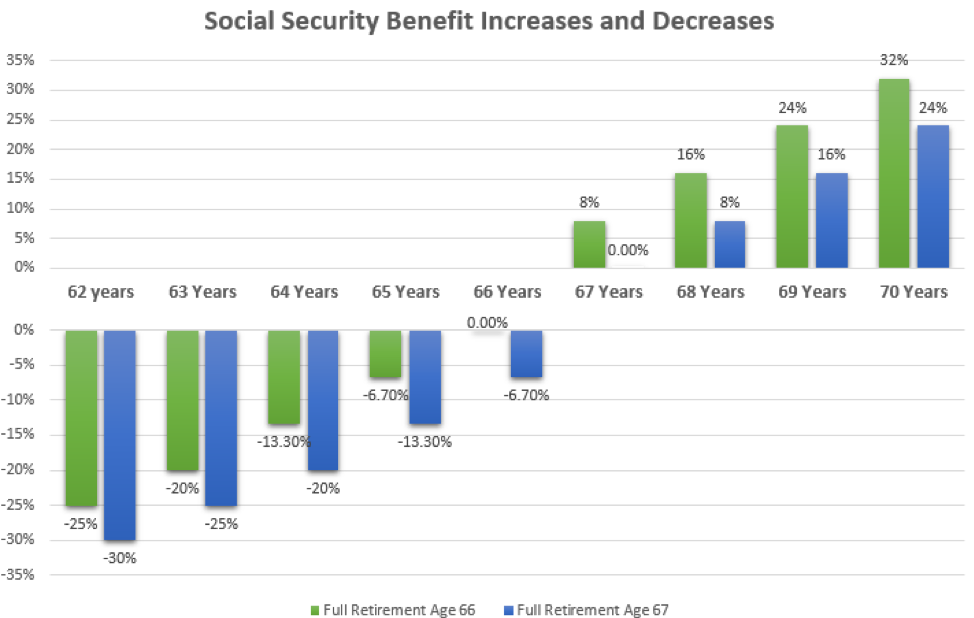

The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. Benefits are also subject to a Cost of Living Adjustment (COLA), even as you collect benefits. Your monthly benefit will also be influenced by the age at which you begin receiving benefits. A person can begin receiving Social Security benefits as early as age 62; however, there is a permanent reduction for every month you begin taking benefits early, up to a 30% decrease. The latest a person must start receiving Social Security by is age 70, and for each month a person delays receiving benefits there is an increase above 100%.

When should I begin my benefits? When is it better to delay benefits?

There are many factors impacting the decision of if you should take Social Security at age 62, 70, or anytime in between. Some of these factors include at what age you retire, your health or your family history, possible taxation of benefits due to income limits, and how much you have already saved for retirement. Social Security benefits generally have a cost of living adjustment (COLA) even when a person chooses to delay benefits, which means you not only experience an 8% increase delaying it by one year from full retirement age, but also the COLA adjustment. The COLA adjustment is important with the average life expectancy of a 65 year old American is 86 and 84 for women and men respectively.

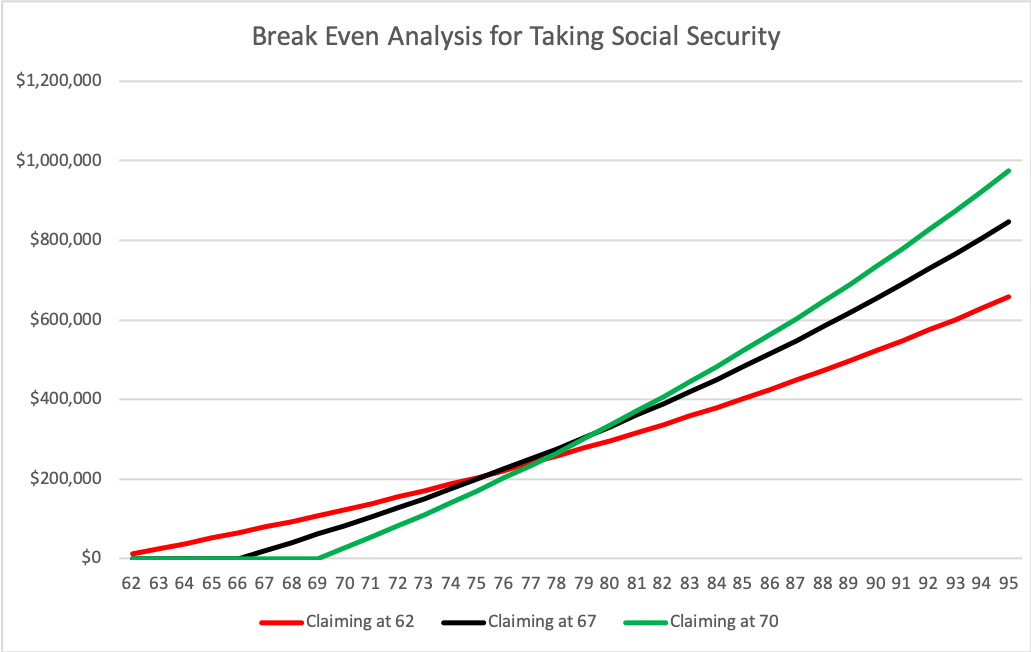

The chart below shows an average American age 62 able to receive a normal retirement age benefit of $1,461. While taking benefits early at 62 will earn more money in the short term, by the time this person turns 76 they would have a cumulative amount greater if they delayed to claiming social security at full retirement age. Furthermore, if this person delayed claiming Social Security until age 70, by the time they reach age 80 they would have a higher cumulative benefit than claiming at full retirement age. To take this one step further, if this average American lived to age 85 the cumulative benefits for starting Social Security at ages 62, full retirement age, and 70 would be $402,024, $481,979, and $521,553 respectively.

The above looks at Social Security alone in an isolated tube. In reality, when determining when one should take Social Security benefits, it would be wise to look at your holistic picture. What types of other savings do you have? Is it saved in taxable accounts, tax deferred accounts, or something like a Roth? What is the longevity track record of your family lines? If you have genes in your family that live beyond mid-80’s, looking at Social Security in an isolated tube would say that you should delay taking Social Security. However, if like many American’s your retirement savings is in a tax deferred account, you will likely need to rely on that retirement savings to a larger degree while waiting to file for Social Security benefits. When doing this, keep in mind that you have to pay taxes on what you pull out of tax deferred account. Therefore, the cost of waiting to file for Social Security is likely to come at the cost of taxes. This is easily confused and can be cumbersome to calculate. If you’re unsure how to even approach it, it would be wise to seek out a financial planner that has a fiduciary responsibility.

What if you continue to work after you have claimed benefits?

Your wages will be subject to Social Security and Medicare taxes, so you will continue to pay into social security. Depending on your earned wages, a portion of the Social Security benefits that you are drawing may be subject to tax as well (up to 85% of the benefit can be taxed). If you earn more than you did in one of the original 35 years that the Social Security Administration used to calculate your original benefit, the new higher earning year’s income will be used to recalculate your benefits and you will be paid any increase that’s due. There is a Social Security income limit, which is the amount of money you can earn before your earnings impact your Social Security benefit. If your income exceeds the Social Security income limit (which is defined based on your specific situation), your Social Security benefits will be reduced. Where it can really get confusing is while you’re working, and drawing on Social Security, depending on your age, part of your Social Security benefit can be reduced by up to half of the benefit until you no longer work.

What resources are available for you?

First you should visit the Social Security Administration’s website at: https://www.ssa.gov. On the website you can set up an account, try out their different calculators, and you can apply for benefits online if desired. You will also be able to verify earnings, estimate benefits, view and print your annual benefit statement, etc. You can also set up an appointment with your local Social Security Administration office to talk with someone in person. It is recommended you file for benefits three months before you actually want to start receiving them in case of glitches. If talking with the SSA does not sound like a good next step, obtain the services of a financial advisor, attorney, or accountant who specializes in, or is knowledgeable about, Social Security.

At TS Prosperity Group, we IGNITE PROSPERITY® by helping our clients do more with their money. Whether it’s saving a little extra cash each month or accomplishing a long-term strategy, our goal is to help you transform your financial life. Call and schedule an appointment today, one of our team members would love to help you do more with your money at TS Prosperity Group. TS Prosperity Group is based in Council Bluffs, Iowa, with clients across the midwest. For more information visit tsprosperitygroup.com or call 844-487-3115. #igniteprosperity

Investment products offered by TS Prosperity Group are: Not a Deposit • Not FDIC Insured • Not Insured by any Federal Government Agency • Not Guaranteed by the Bank • May Go Down in Value.

|

Matt Riley, ChFC®, ChSNC®

Fiduciary Officer, VP

Matt Riley was named Fiduciary Officer and VP at our affiliate bank, First National Bank and Trust Company in Clinton, Illinois, in January 2019. Riley has four years of experience in risk analysis, serving most recently as a Risk and Compliance Analyst at a bank in Bloomington, Illinois. As a Fiduciary Officer, Riley will manager First National Bank and Trust Company's and The Bank of Tioga's trust portfolios while helping clients find new ways to meet their prosperity goals.

|