Save For Your Health: Open a Health Savings Account (HSA)

You save for rainy days and retirement, but do you remember to save for your own health? This account lets you save money to spend on medical expenses, like doctor visits and prescription medication.

Unlike other health plans, you own this account — not your employer. So the money is yours to roll over year-to-year, and you can use the funds any time — whether it's six months or six years from now.

- Must be covered under a high deductible healthcare plan

- No setup or annual fees

- Contributions are tax deductible*

- Interest grows tax free*

- Withdrawals are tax free* when used for qualified medical expenses

- Money rolls over year-to-year automatically

- HSA is owned by you, not employer

- Easy withdrawal access

- Debit card option available

What is an HSA?

You probably save for rainy days and retirement, but do you remember to save for your own health? An HSA or Health Savings Account lets you save money to spend on medical expenses, like doctor visits and prescription medication.

How does an HSA work?

Unlike other health plans, you own this account — not your employer. So the money is yours to roll over year-to-year, and you can use the funds any time — whether it's six months or six years from now. Contributions are tax deductible and can grow interest that is tax-free*. Withdrawals are also tax free* when used for qualified medical expenses.

What’s the catch?

You must be covered under a high deductible healthcare plan. You will need to work with your tax advisor (check out Collins Consulting) to determine your eligibility. There is an annual contribution limit on HSAs. Consult a tax advisor or reach out to the bank for these limits as they can change annually.

How do I spend the money in my HSA account?

You should have easy access to the funds in your health savings account. HSA account holders can order both checks and/or a debit card and there is typically no limit to the number of transactions you can have per month.

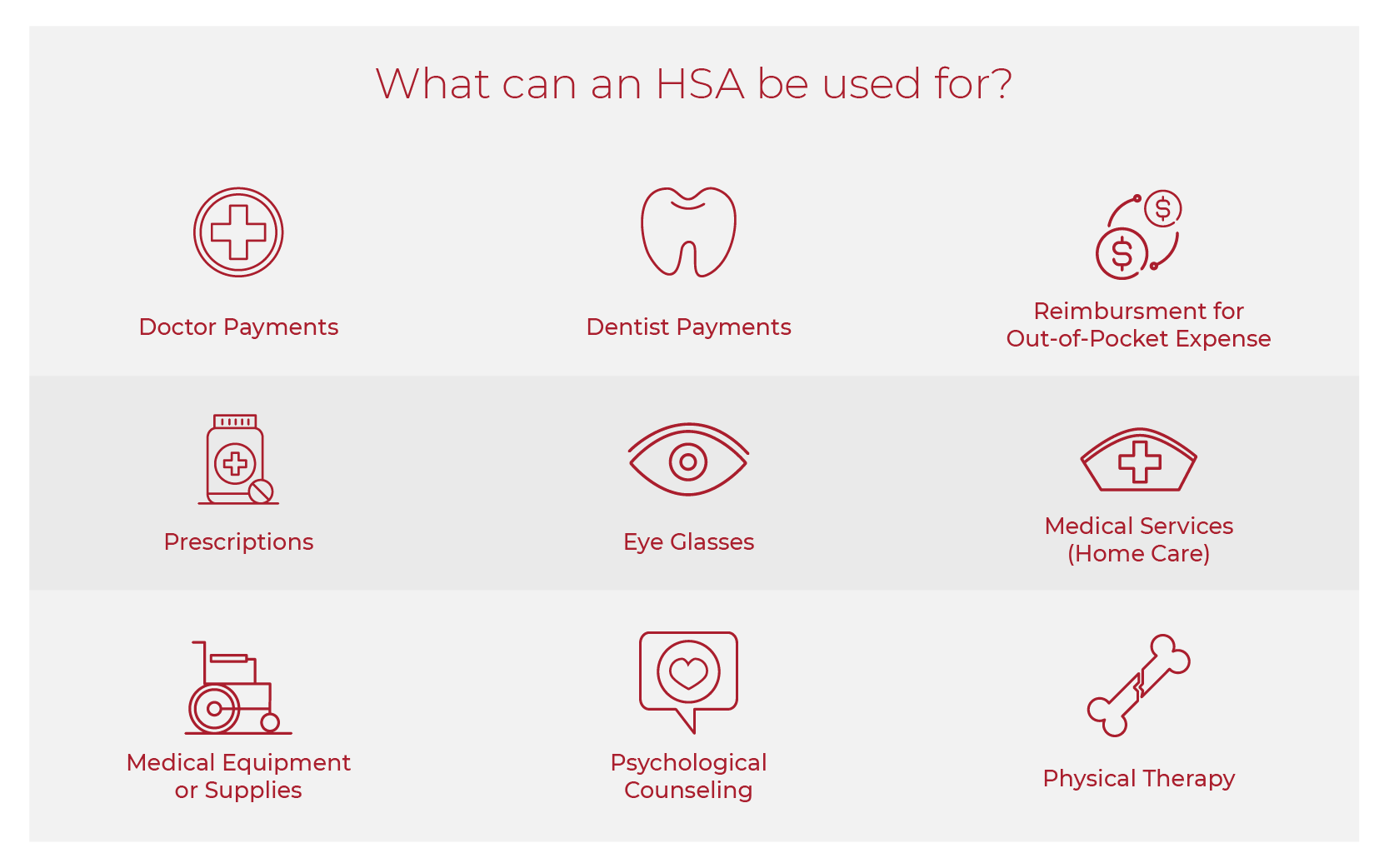

The above items may qualify.

What do I need to open an HSA?

You will need your driver’s license, address (if different from your driver's license, you will need proof of that address), your social security number, your date of birth and a deposit that meets your bank’s minimum amount required. It’s also important to think about who your beneficiary on this account will be. You will need their name, address, birthdate and social security number. You can also identify an authorized signer, however, a joint owner is not allowed.

What comes with an HSA account?

HSA accounts come with perks including access to online, mobile banking and a debit card. Learn more by clicking on the icons.

Can I add my HSA account to my digital wallet?

Yes! With digital wallets, you can have a touch-less experience at the checkout. Where accepted, simply hold up your phone to pay for your purchase on most smart phones.

How do I open an HSA account?

If you’re interested in learning more about Health Savings Accounts or would like to open a HSA at TS Bank, simply contact us via phone, email, in-person or choose "Connect Now" below to get started!

DO MORE with your money at TS Bank

At TS Bank, we IGNITE PROSPERITY® by helping our clients do more with their money. Whether it’s saving a little extra cash each month or accomplishing a long-term strategy, our goal is to help you transform your financial life. Call and schedule an appointment today, one of our team members would love to help you do more with your money at TS Bank. TS Bank has seven locations in central and southwest Iowa. For more information visit tsbank.com or call 844-487-3030. #igniteprosperity