2021 Child Tax Credit Payments - What should I know?

June 23, 2021 | Collins Consulting

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting professionals before engaging in any transaction based on the information provided here.

Last week, the IRS sent a letter to taxpayers who may qualify for monthly Child Tax Credits introducing this new program. Families who are eligible for advance Child Tax Credits payments will receive a second, personalized letter listing an estimate of their monthly payment sometime after July 15. We have listed and answered some frequently asked questions below regarding this new tax credit and to help you navigate what's changed along with how it may affect you, your family and your 2021 taxes.

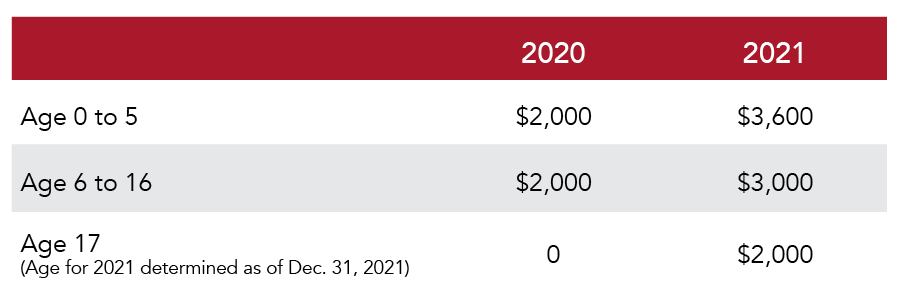

What changes were made in the amount of child tax credit?

How will the child tax credit be advanced?

In the past, the child tax credit was issued when an annual tax return was filed. For 2021, beginning July 15 - Dec 15, the IRS will automatically issue a monthly payment for 1/12 of the annual child tax credit (refer to amounts listed above) via check or direct deposit (if the IRS knows a taxpayer’s bank account number). The IRS will determine the advance amounts from a 2020 tax return if filed. Or, if a 2020 tax return was not filed, the IRS will use a 2019 tax return.

What information will be needed for my 2021 tax return?

You will need to track exactly how much advance child tax credit you received. It’s the intention of the IRS to send a letter in January 2022 of the amount that you have received. However, we highly encourage taxpayers to keep their own documentation in case the IRS does not deliver as intended and/or to confirm the actual amount received for your tax return. If the amount is not known, it will delay the preparation of your tax return and tax refund.

What if I’ve changed address or bank account information?

The IRS is developing an online portal to advise the IRS of any changes but it is not available at this time.

What if I had an additional child in 2021 or I cannot claim a child in 2021 that I claimed in 2020?

The IRS is developing an online portal to advise the IRS of any changes but it is not available at this time.

What if I do not want the advance child tax credit monthly and prefer to apply credit on my 2021 tax return as I have in the past?

The IRS is developing an online portal to allow an option to elect out of the advance. There is no correct or incorrect election. It’s the same amount, either paid monthly or annually on the 2021 tax return.

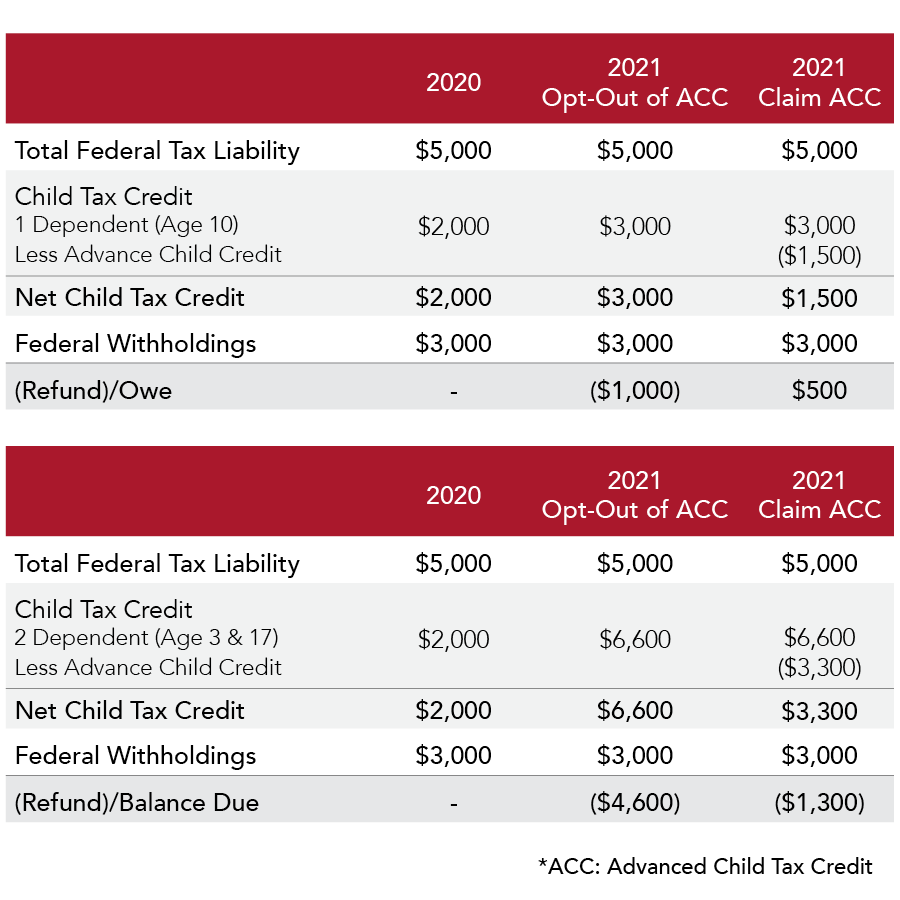

Can you give me an example or two?

Will the advance child tax credit affect my tax refund for 2021?

Yes. The advance child tax credit claimed on the 2021 tax return will be reduced by any advance payments received. If the advance payments received exceed the credit allowed, the excess will be added to your 2021 tax liability and repaid.

What changes were made to dependent care credit?

For 2021 only, child and dependent care for one child was increased from $3,000 to $4,000 and or two or more children from $6,000 to $8,000.

A phase-out may apply if income above certain threshold amounts for both child tax credit and dependent care credits (adjusted gross income above $75,000 for single, $112,500 for head of household and $150,000 for married.)

JUNE 28 UPDATE: The IRS has now released two new tools available for you at irs.gov. These tools offer information to determine if you are eligible for the advanced child tax credit and allows you an option to unenroll. To access this portal, you will be required to setup an account (username and password) using the id.me link on the IRS website.

IMPORTANT ITEMS TO NOTE

- If you and your spouse file taxes jointly and you wish to unenroll from this program, you will BOTH need to set up separate accounts to successfully unenroll. If only one of you unenrolls, half of the Advanced Child Tax Credit will be issued.

- Once you have unenrolled, you CANNOT re-enroll in this program.

If you have any questions, contact us online or give us a call at (712) 487-3853.

About Collins Consulting: Collins Consulting is a full-service tax and accounting firm, started in 1970 by Norm Collins in Treynor, Iowa. In August of 2018, TS Banking Group acquired Collins Consulting as a wholly-owned subsidiary.